How AI GST Invoice Scanner WhatsApp Works in 2026: Complete Guide

In 2025, Indian businesses are ditching complicated GST software for something far simpler: AI GST invoice scanner WhatsApp. Imagine verifying a vendor’s GST invoice in just 30 seconds—without opening any app, without logging into the GST portal, and without calling your CA. That’s exactly what an AI GST invoice scanner WhatsApp does.

For MSMEs handling 50+ invoices monthly, manual verification wastes 4-6 hours per week. Wrong GSTIN numbers, calculation errors, and fake invoices can lead to ITC reversals and penalties up to ₹25,000. This guide explains how the AI GST invoice scanner WhatsApp solves these problems using cutting-edge OCR and AI technology.

💡 Quick Facts:

- Average scanning time: 30 seconds per invoice

- Accuracy rate: 98.5% (trained on 100,000+ Indian invoices)

- Cost: ₹2 per scan (vs ₹500 CA consultation)

- Languages supported: English, Hindi, Hinglish

What is an AI GST Invoice Scanner on WhatsApp?

An AI GST invoice scanner WhatsApp is an automated compliance tool that uses Optical Character Recognition (OCR) and Artificial Intelligence to extract, verify, and validate GST invoice data—all through a simple WhatsApp chat. You don’t need to download any app or create an account. Just send an invoice image or PDF, and get instant analysis.

How It Differs from Traditional GST Software

| Feature | BizplanAI Pro WhatsApp Scanner | Traditional Software |

|---|---|---|

| Platform | WhatsApp (No app needed) | Desktop software/Web login |

| Invoice Input | Photo/PDF upload | Manual data entry |

| Processing Time | 30 seconds | 5-10 minutes per invoice |

| GSTIN Verification | Real-time (live database) | Manual portal check |

| Cost Model | Pay-per-use (₹2) | Annual subscription (₹10,000+) |

| Accessibility | 24/7 from any device | Office computer only |

The key advantage? Zero friction. Your accountant, warehouse manager, or purchase team can verify invoices instantly on their phones—no training required. Just WhatsApp it.

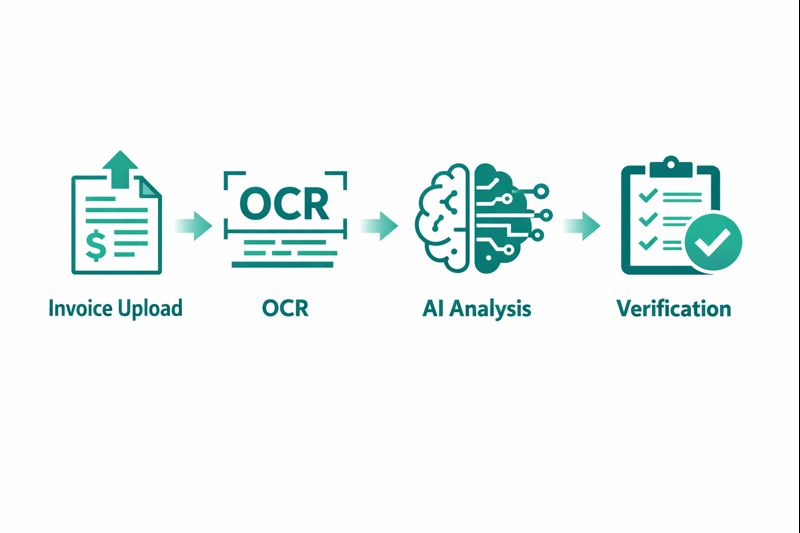

How Does the AI GST Invoice Scanner WhatsApp Work?

The AI GST invoice scanner WhatsApp operates through a 5-step automated process that takes less than 30 seconds:

Step 1: Upload Invoice Image/PDF

You send the invoice to the WhatsApp bot (Smart GST Auditor). The scanner accepts:

- PDF documents (single or multi-page)

- Images (JPG, PNG, JPEG)

- Photographed invoices (even slightly blurry ones)

The AI can read both printed and handwritten invoices. No need for perfect scan quality—just ensure the text is readable.

Step 2: OCR Extraction

Advanced Optical Character Recognition extracts these fields:

- Supplier GSTIN (15-digit number)

- Invoice number and date

- Taxable amount, CGST, SGST/IGST rates

- Total invoice value

- HSN/SAC codes

- Place of supply

The OCR is trained on 100,000+ Indian invoices and recognizes various formats—from Excel-generated PDFs to Tally prints to handwritten bills.

Step 3: GSTIN Verification

The scanner checks the supplier’s GSTIN against the live GST database:

- ✅ Is the GSTIN active or cancelled?

- ✅ Does the business name match?

- ✅ Is the registration type correct (Regular/Composition)?

- ✅ When was it registered?

If the GSTIN is invalid, cancelled, or suspended, you get an instant alert: “⚠️ Warning: This GSTIN is inactive. ITC not eligible.”

Step 4: Tax Calculation Validation

The AI recalculates the GST to verify accuracy:

- Checks if tax rate matches HSN/SAC code

- Validates CGST + SGST = Total GST (for intra-state)

- Confirms IGST rate (for inter-state)

- Detects calculation errors (even ₹1 discrepancies)

Real Example: A Mumbai textile trader received an invoice with 12% GST on cotton fabric (HSN 5208). The scanner flagged it—cotton fabric attracts 5% GST. This saved ₹14,000 in wrongly claimed ITC that would’ve been reversed during audit.

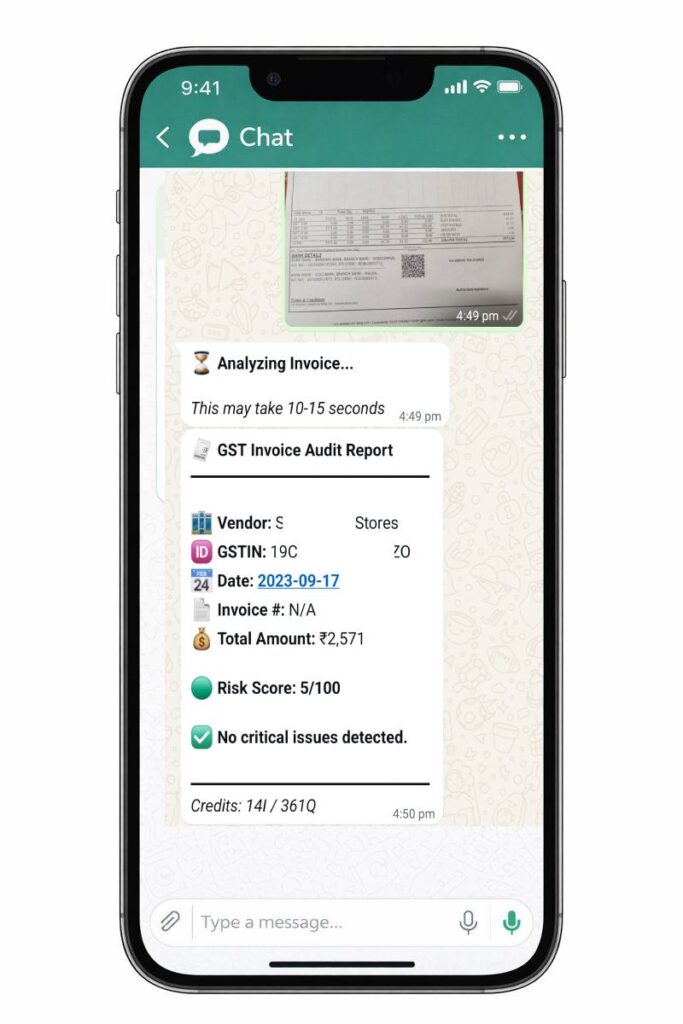

Step 5: Error Reporting

Within 30 seconds, you receive a detailed WhatsApp report:

- ✅ Green checkmark: Invoice is compliant, ITC eligible

- ⚠️ Yellow warning: Minor issues (e.g., missing PAN on high-value invoice)

- ❌ Red alert: Critical errors (fake GSTIN, wrong tax rate, calculation mismatch)

The report is plain-English (or Hindi), not tax jargon. Example: “GSTIN verified ✅ | Tax calculation correct ✅ | ITC can be claimed ✅”

🎯 Try AI GST Invoice Scanner WhatsApp Free

Scan your first invoice right now. No registration, no credit card.

Key Features of AI GST Invoice Scanner WhatsApp

1. Real-Time GSTIN Verification

Unlike manual portal checks, the AI GST invoice scanner WhatsApp verifies GSTIN in real-time using government APIs. This catches:

- Cancelled registrations: Suppliers who’ve shut down

- Suspended GSTINs: Businesses under investigation

- Fake numbers: Invalid or randomly generated GSTINs

2. Multi-Format Support

The scanner handles all common formats:

- PDF (from Tally, Busy, Zoho Books, QuickBooks)

- JPG/PNG images (phone camera photos)

- Multi-page invoices (up to 10 pages)

- Low-resolution scans (AI enhances readability)

3. Hindi/English Language Support

You can ask questions in Hindi, English, or Hinglish:

- “Ye invoice sahi hai?” (Is this invoice correct?)

- “Can I claim ITC on this?”

- “GST rate kya hona chahiye?” (What should the GST rate be?)

The bot responds in the same language you use.

4. Instant Error Detection

The AI flags 7 common invoice errors:

- Invalid or inactive GSTIN

- Wrong tax rate for HSN code

- Calculation mistakes (CGST + SGST ≠ Total)

- Missing mandatory fields (invoice date, place of supply)

- Incorrect IGST on inter-state sales

- Reverse charge not mentioned (if applicable)

- Composition dealer charging GST

5. ITC Eligibility Check

The scanner tells you if Input Tax Credit can be claimed:

- Eligible: “You can claim ₹1,800 ITC on this invoice ✅”

- Not Eligible: “ITC blocked—supplier is composition dealer ❌”

- Partial Eligible: “Only 50% ITC allowed (motor vehicle for business use)”

Benefits for Indian MSMEs

Save 4+ Hours Per Week

Manual invoice verification for a business with 200 monthly invoices:

- Time per invoice: 3 minutes (GSTIN check, calculation verify)

- Total time: 600 minutes = 10 hours/month

With AI GST invoice scanner WhatsApp:

- Time per invoice: 30 seconds

- Total time: 100 minutes = 1.6 hours/month

- Time saved: 8.4 hours/month (₹4,000+ in labor cost)

Reduce Compliance Errors by 90%

Common mistakes humans make (but AI doesn’t):

- Missing the 3rd digit mismatch in a 15-digit GSTIN

- Not noticing a vendor switched from Regular to Composition

- Accepting ₹5 tax calculation difference as “rounding error”

- Claiming ITC on motor vehicles (not allowed for most businesses)

Cost Comparison: ₹2 vs ₹500

| Scenario | CA Consultation | BizplanAI Pro WhatsApp Scanner |

|---|---|---|

| Single invoice verification | ₹500 (minimum charge) | ₹2 |

| 50 invoices/month | ₹25,000 | ₹100 |

| 200 invoices/month | ₹1,00,000 | ₹400 |

| Annual cost (2,400 invoices) | ₹12,00,000 | ₹4,800 |

Real Use Cases

Case Study 1: Textile Trader in Surat

Business: Rajesh Fabrics, wholesale textile distributor

Challenge: Receiving 300+ supplier invoices monthly. 15% had errors (wrong GST rates, fake GSTINs). Manual checking took 12 hours/week.

Solution: Started using AI GST invoice scanner WhatsApp in August 2025.

Results:

- ✅ Verification time: 12 hours → 2 hours (83% reduction)

- ✅ Caught 42 fake GSTINs in first month (saved ₹1.2L ITC reversal)

- ✅ Monthly cost: ₹600 (300 scans × ₹2)

- ✅ ROI: 20x (saved ₹12,000 in labor cost alone)

Owner’s Quote: “Pehle accountant raat 10 baje tak invoices check karta tha. Ab WhatsApp pe 30 second mein ho jaata hai.” (Earlier our accountant checked invoices till 10 PM. Now it takes 30 seconds on WhatsApp.)

Case Study 2: Restaurant Chain in Mumbai

Business: Spice Kitchen, 8-outlet restaurant chain

Challenge: Daily purchases from 50+ vendors (vegetables, meat, spices, packaging). Branch managers had no way to verify invoices on-site.

Solution: Branch managers now scan invoices immediately upon delivery using WhatsApp bot.

Results:

- ✅ Detected 8 composition dealers wrongly charging GST (rejected ₹45K wrongful ITC claim)

- ✅ Identified 3 vendors with cancelled GSTIN (stopped purchases immediately)

- ✅ Branch managers can verify without calling head office

- ✅ Zero GST notices in last 6 months (previously 2-3 annually)

How to Get Started

Getting started with the AI GST invoice scanner WhatsApp takes less than 2 minutes:

- Save the WhatsApp Number: +91 80177 76372

- Send “Hi” to start the conversation

- Upload your first invoice (photo or PDF)

- Receive instant verification in 30 seconds

No registration. No credit card. No monthly fees. You only pay ₹2 when you scan an invoice. The first 2 scan is free to test the service.

🎯 Start Verifying GST Invoices in 30 Seconds

Join 1,250+ Indian businesses using our AI GST invoice scanner WhatsApp. Try your first scan free.

Frequently Asked Questions

Q: Is the AI GST invoice scanner WhatsApp secure?

A: Yes, absolutely. All data is encrypted with 256-bit SSL. Your invoice data is processed temporarily for analysis and never stored permanently. We comply with data protection regulations. The bot cannot access your WhatsApp contacts or other messages.

Q: What file formats does the AI GST invoice scanner WhatsApp support?

A: The scanner supports PDF, JPG, PNG, and JPEG formats. You can upload both single-page and multi-page invoices (up to 10 pages). Image quality should be clear enough to read text—no need for professional scans, phone photos work fine.

Q: Can the AI GST invoice scanner detect fake invoices?

A: Yes. The scanner verifies GSTIN authenticity in real-time against government databases, checks for mathematical errors, validates HSN codes against tax rates, and flags suspicious patterns that indicate fake invoices. If the GSTIN is invalid, cancelled, or suspended, you get an immediate alert.

Q: How much does the AI GST invoice scanner WhatsApp cost?

A: It costs only ₹2 per invoice scan. There’s no monthly subscription, no hidden fees, and no minimum commitment. You only pay for what you use. The first scan is free to test the service. For businesses scanning 100+ invoices monthly, bulk pricing is available.

Q: Does it work for all types of businesses?

A: Yes. The AI GST invoice scanner WhatsApp works for traders, manufacturers, service providers, restaurants, retailers, and any business registered under GST. It handles B2B invoices, export invoices, and even bills of supply from composition dealers.

Q: Can I scan invoices in regional languages?

A: Currently, the OCR reads invoices in English and Hindi. The bot conversation supports Hindi, English, and Hinglish. We’re adding Gujarati, Tamil, and Telugu support in Q1 2026.

Q: What if the scanner gives a wrong result?

A: The AI has 98.5% accuracy, but if you believe the result is incorrect, you can escalate to a human tax expert within the chat. We review disputed cases within 2 hours and refund the ₹2 if our AI made an error.

Conclusion

The AI GST invoice scanner WhatsApp is transforming how Indian MSMEs handle GST compliance. Instead of spending hours manually checking invoices or paying hefty CA fees, businesses can now verify invoices in 30 seconds for just ₹2.

With real-time GSTIN verification, automatic error detection, and instant ITC eligibility checks, the scanner catches mistakes that cost businesses thousands in penalties and reversed credits. It works 24/7, requires no training, and runs entirely on WhatsApp—the platform your team already uses.

Whether you’re a textile trader in Surat handling 300 invoices monthly or a restaurant owner in Mumbai verifying daily purchases, the AI GST invoice scanner WhatsApp saves time, reduces errors, and ensures compliance with FY 2025-26 GST laws.

Ready to scan your first invoice? Start chatting on WhatsApp now or visit our GST Consultant AI Main Page to learn more.