How AI is Revolutionizing GST Compliance in India

Revolutionizing GST Compliance in India: The Power of AI

India’s Goods and Services Tax (GST) regime has transformed the country’s indirect tax structure, aiming to simplify and streamline taxation for businesses. However, with the introduction of GST, compliance has become more complex, requiring businesses to adhere to stringent rules and deadlines. In this evolving landscape, Artificial Intelligence (AI) is emerging as a game-changer, offering innovative solutions to automate and optimize GST compliance processes. From automating invoice matching to detecting fraud, AI is reshaping the way businesses handle tax compliance in India.

The Role of AI in GST Compliance

Artificial Intelligence has been making waves across industries, and the tax domain is no exception. In the context of GST compliance, AI brings automation, predictive analytics, and data-driven insights that help businesses maintain compliance with minimal human intervention. The integration of AI into GST systems is not just about efficiency—it’s about ensuring accuracy, reducing errors, and enhancing transparency.

What is GST Compliance?

GST compliance refers to the set of rules and procedures that businesses must follow to report and pay GST on goods and services. This includes filing GSTR-3B, GSTR-1, GSTR-2A, and other periodic returns. Non-compliance can lead to penalties, interest, and legal complications, making it crucial for businesses to stay on top of their obligations.

Challenges in GST Compliance

Managing GST compliance is a complex task, particularly for businesses dealing with a high volume of transactions. Some of the key challenges include:

- Manual data entry errors

- Time-consuming reconciliation of invoices

- Keeping up with changing tax laws and rates

- Ensuring accurate reporting and filing within deadlines

- Dealing with discrepancies between input and output tax credits

These challenges often result in late filings, mismatched invoices, and compliance risks. This is where AI steps in, offering scalable and efficient solutions to address these pain points.

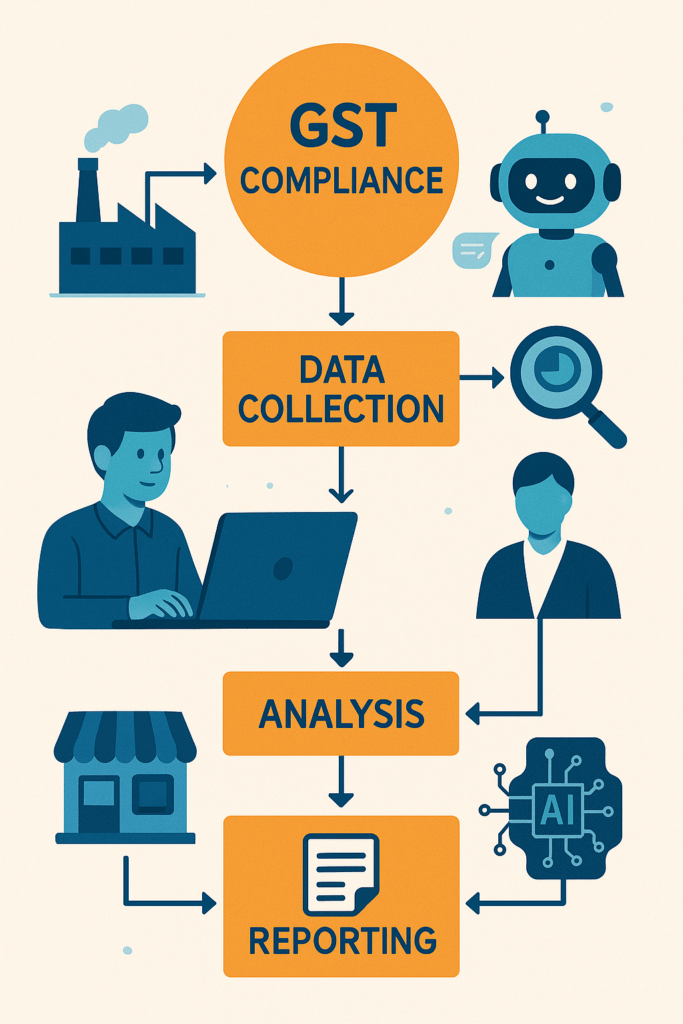

Benefits of AI in GST Compliance

AI-driven GST compliance solutions are designed to streamline the entire process, from data collection to reporting. Here are some of the key benefits that AI brings to the table:

1. Automation of Routine Tasks

One of the most significant advantages of AI in GST compliance is automation. Tasks such as invoice matching, data entry, and return generation can be automated, reducing the need for manual intervention. This not only saves time but also minimizes the risk of human error.

For example, AI-powered systems can automatically extract data from invoices and match them against purchase and sales records. This ensures that businesses have accurate data to file their GST returns.

2. Real-Time Analytics and Reporting

AI enables real-time analytics by processing vast amounts of data quickly. This allows businesses to monitor their GST compliance status in real-time and generate reports as needed. AI tools can also flag anomalies and discrepancies instantly, helping businesses take corrective actions before they escalate.

3. Fraud Detection and Prevention

Fraudulent activities such as fake invoices and tax evasion are a major concern in the GST system. AI can detect suspicious patterns and flag potentially fraudulent transactions using machine learning algorithms. By analyzing historical data and identifying red flags, AI systems help prevent tax fraud and ensure a fair tax environment.

4. Predictive Insights and Decision-Making

AI can provide predictive insights by analyzing past data and identifying trends. This helps businesses anticipate compliance challenges and make informed decisions. For instance, AI can predict potential mismatches in input and output tax credits, allowing businesses to address them proactively.

5. Scalability and Cost-Efficiency

AI solutions are highly scalable, making them ideal for businesses of all sizes. Whether it’s a small enterprise or a large corporation, AI systems can be tailored to handle varying volumes of transactions without a significant increase in cost. This scalability ensures that businesses can maintain compliance efficiently without the need for large teams of accountants.

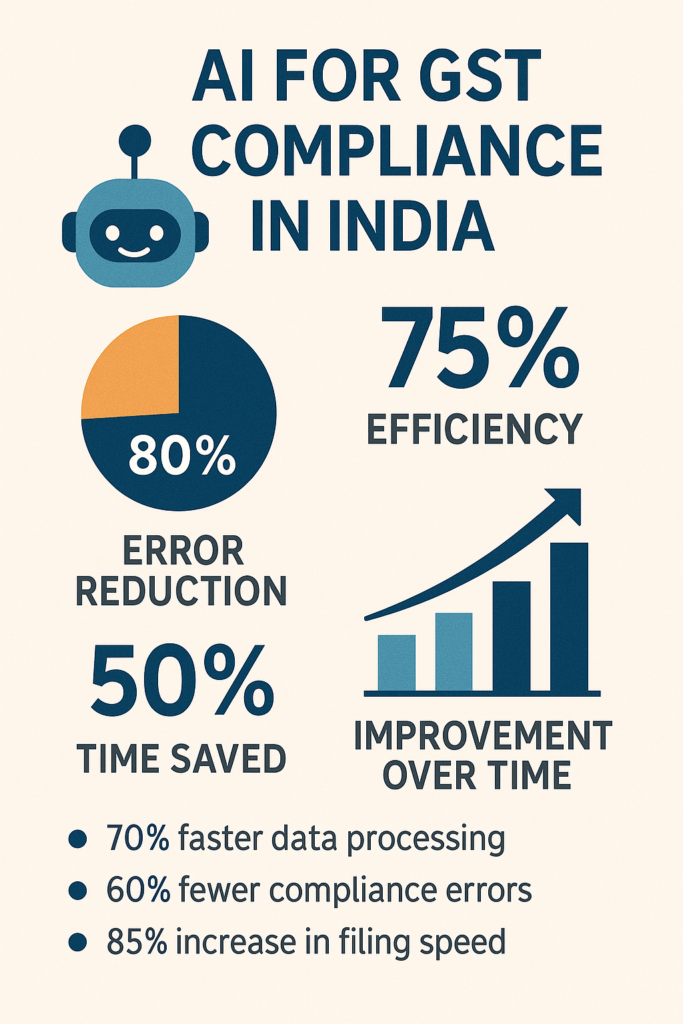

Real-World Examples of AI in GST Compliance in India

While many businesses are still in the early stages of adopting AI for GST compliance, there are already several success stories that highlight the transformative potential of this technology. Let’s explore a few real-world examples of companies in India that have successfully implemented AI-driven GST solutions.

Case Study 1: E-commerce Giant Leverages AI for GST Automation

A major e-commerce company in India faced challenges in reconciling thousands of daily transactions and ensuring accurate GST reporting. The manual process was not only time-consuming but also prone to errors. The company decided to implement an AI-powered GST automation tool that integrated with their accounting system.

The AI system automatically captured data from invoices, matched them with purchase orders, and generated accurate GST returns. It also flagged discrepancies and provided real-time reports. As a result, the company reduced its compliance processing time by over 60% and significantly minimized errors in reporting.

Case Study 2: Manufacturing Firm Uses AI for Fraud Detection

A mid-sized manufacturing firm in Gujarat was struggling with a high number of fraudulent input tax credit claims. The company partnered with an AI startup that developed a GST compliance tool with advanced fraud detection capabilities. The tool used machine learning algorithms to analyze invoice patterns and identify suspicious transactions.

Within a few months, the AI system detected over 50 fraudulent invoices that were previously missed during manual checks. The company was able to recover a significant amount in input tax credits and avoided potential penalties. The implementation of AI not only improved their compliance but also enhanced their financial integrity.

Case Study 3: SMEs Adopt AI for Simplified Compliance

Small and medium-sized enterprises (SMEs) often lack the resources to hire dedicated compliance teams. Recognizing this gap, a fintech company in India launched an AI-powered GST compliance platform tailored for SMEs. The platform offered features like automated invoice processing, real-time return generation, and compliance alerts.

Over 10,000 SMEs adopted the platform within the first year. The AI system simplified their GST compliance process, reducing the time and cost involved. The platform also provided educational resources to help users understand their compliance obligations better.

Expert Insights: The Future of AI in GST Compliance

To gain a deeper understanding of AI’s role in GST compliance, we spoke with industry experts and tax professionals. Their insights provide valuable perspectives on the future of AI in this domain.

Interview with Ravi Mehta, Tax Consultant

“AI is not just a tool for compliance—it’s a strategic asset for businesses,” says Ravi Mehta, a leading tax consultant in Mumbai. “With AI, we can move from reactive compliance to proactive compliance. Businesses can now predict compliance risks, optimize tax credits, and even prepare for audits with greater confidence.”

Ravi highlights that while AI offers numerous benefits, it’s essential for businesses to understand the technology’s limitations. “AI is only as good as the data it’s trained on. If the data is inaccurate or incomplete, the results can be misleading. That’s why it’s crucial to have a robust data governance framework in place.”

Interview with Priya Nair, Fintech Entrepreneur

Priya Nair, the founder of a fintech startup that specializes in AI-driven tax solutions, emphasizes the importance of user-friendly AI tools. “Our goal is to make AI accessible to every business, regardless of their size or technical expertise. We’ve designed our platform to be intuitive, with minimal setup required. Users can start using it within minutes, and the system adapts to their workflow over time.”

Priya also points out that AI can help businesses stay updated with the latest tax laws. “We’ve integrated a feature that tracks changes in GST regulations and alerts users when a new rule is introduced. This ensures that businesses are always compliant, even when the rules change.”

Challenges and Limitations of AI in GST Compliance

While AI has immense potential, it’s not without its challenges. Here are some of the key limitations and obstacles that businesses may face when implementing AI for GST compliance:

1. Data Privacy and Security Concerns

AI systems require access to sensitive financial data, which raises concerns about data privacy and security. Businesses must ensure that their AI tools comply with data protection regulations and implement robust security measures to prevent data breaches.

2. Integration with Existing Systems

Many businesses use legacy accounting systems that may not be compatible with AI-driven GST solutions. Integrating AI with these systems can be complex and may require significant investment in IT infrastructure.

3. High Initial Investment

Implementing AI for GST compliance can be a costly endeavor, especially for small businesses. The initial investment includes software licensing, hardware upgrades, and employee training. However, the long-term cost savings often outweigh these initial expenses.

4. Lack of Awareness and Expertise Many businesses are still unfamiliar with AI and its applications in tax compliance. There is a lack of trained professionals who can implement and manage AI systems effectively. This knowledge gap can hinder the adoption of AI in the GST domain.

Overcoming the Challenges of AI in GST Compliance

Despite these challenges, there are several strategies that businesses can adopt to overcome the limitations of AI and ensure successful implementation:

1. Partner with Reputable AI Providers

Choosing the right AI provider is crucial. Businesses should partner with vendors that have a proven track record in the tax compliance space and offer reliable customer support. A reputable provider can help businesses navigate the complexities of AI implementation and ensure seamless integration with existing systems.

2. Invest in Employee Training

Training employees to use AI tools effectively is essential. Businesses should provide regular training sessions to help employees understand the capabilities and limitations of AI systems. This ensures that they can leverage AI to its full potential and avoid common pitfalls.

3. Start with a Pilot Project

Before implementing AI on a large scale, businesses can start with a pilot project to test the technology in a controlled environment. This allows them to identify any issues and make necessary adjustments before rolling out AI across the entire organization.

4. Focus on Data Quality

As AI systems rely on data for accurate predictions and insights, businesses must ensure that their data is clean, accurate, and up-to-date. Implementing data governance policies and using data validation tools can help improve data quality and enhance the performance of AI systems.

Future Trends in AI and GST Compliance

The future of AI in GST compliance looks promising, with several trends emerging that could further enhance its impact. Here are some of the trends to watch:

1. Integration with Blockchain Technology

Blockchain technology is gaining traction in the tax compliance space due to its transparency and security features. When integrated with AI, blockchain can help ensure that GST data is tamper-proof and easily auditable. This combination can significantly reduce the risk of fraud and enhance trust in the tax system.

2. Use of Natural Language Processing (NLP)

Natural Language Processing (NLP) is a branch of AI that enables machines to understand and interpret human language. In the context of GST compliance, NLP can be used to extract relevant information from unstructured data sources such as emails, contracts, and chatbots. This can streamline data entry and improve the accuracy of GST reporting.

3. AI-Powered Chatbots for Tax Advisory

AI-powered chatbots are being developed to provide real-time tax advisory services to businesses. These chatbots can answer common questions about GST compliance, provide guidance on tax deductions, and even help users file returns. This can be particularly beneficial for small businesses that lack dedicated tax experts.

4. Predictive Analytics for Risk Management

As AI continues to evolve, its predictive analytics capabilities will become more advanced. In the future, AI systems will be able to predict compliance risks with greater accuracy, allowing businesses to take proactive measures to avoid penalties and legal complications.

Conclusion: Embracing AI for Smarter GST Compliance

The integration of AI into GST compliance is not just a technological advancement—it’s a strategic move that can help businesses thrive in an increasingly complex tax environment. From automating routine tasks to detecting fraud and providing real-time insights, AI is revolutionizing the way businesses handle tax compliance in India.

While there are challenges to overcome, the benefits of AI far outweigh the risks. By investing in AI-driven GST solutions, businesses can reduce costs, improve accuracy, and stay ahead of compliance deadlines. As the technology continues to evolve, we can expect even more innovative applications of AI in the GST domain.

For finance professionals, accountants, and business owners, now is the time to explore AI-driven GST solutions and prepare for the future of tax compliance. With the right tools and strategies in place, businesses can leverage AI to achieve greater efficiency, transparency, and compliance in their GST reporting processes.

As India continues to digitize its tax systems, AI will play an increasingly important role in shaping the future of GST compliance. The question is not whether AI will transform GST compliance in India—it’s how quickly businesses will adopt this technology to stay competitive and compliant.